Emergencies can happen at any time, and they often come with a financial burden. Whether it's a medical emergency or a sudden car repair, unexpected expenses can be difficult to manage. One option that many people turn to in these situations is borrowing money. But traditional lending options can be slow, require good credit, and may involve high-interest rates. Fortunately, there are now several borrow money apps available that can provide quick access to cash when you need it most.

It's an unexpected medical expense or a sudden home repair, the cost can add up quickly, leaving you struggling to make ends meet. In these situations, borrowing money can be a necessary solution. However, traditional lending options can be slow, require good credit, and may involve high-interest rates. Fortunately, there are now several borrow money apps available that can provide quick access to cash when you need it most. In this article, we'll explore the benefits of using these apps for emergencies, and how they can offer a more convenient and accessible alternative to traditional lenders.

Convenience

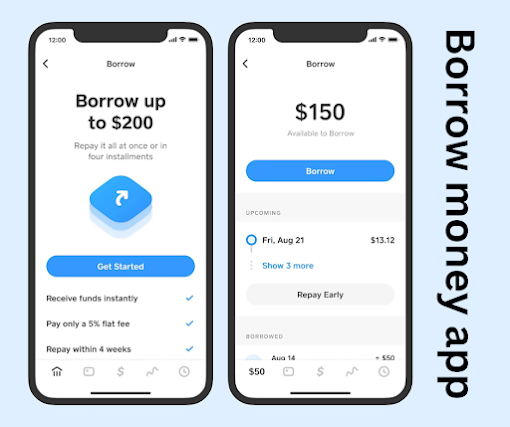

One of the most significant benefits of using borrowed money apps is the convenience they offer. Unlike traditional lenders, who often require extensive documentation and have strict eligibility criteria, these apps are designed to be user-friendly and accessible. Many apps can be downloaded directly to your smartphone or tablet, allowing you to apply for a loan from the comfort of your own home.

Most apps have a streamlined application process that can be completed in minutes. They typically only require basic information such as your name, address, and employment status, and may even offer pre-approval options based on your credit score. This means you can receive a loan offer quickly and with minimal effort.

Another aspect of convenience is the speed at which you can receive the funds. Traditional lenders can take days or even weeks to process an application and transfer the funds, which can be a problem in emergency situations. In contrast, many borrow money apps offer instant approval and can transfer the money to your bank account within minutes. This can make all the difference when you need funds urgently to cover unexpected expenses.

Overall, the convenience of using borrowed money apps for emergencies can help alleviate some of the stress and uncertainty that comes with financial emergencies. With a streamlined application process and fast access to funds, these apps can offer a more accessible and user-friendly solution to borrowing money.

Also Read: How to put money on the cash apps card at ATM?

Accessibility

One of the biggest advantages of using borrowed money apps is their accessibility. Unlike traditional lenders, who often require good credit scores and extensive documentation, these apps are designed to be more inclusive and user-friendly. They cater to a wider range of customers, including those with lower credit scores or no credit history at all.

Most borrow money apps have flexible eligibility criteria, which means they are more likely to consider your application even if you have a less-than-perfect credit score. Some apps use alternative methods to assess your creditworthiness, such as analyzing your income and spending habits. This means that even if you have been turned down by traditional lenders in the past, you may still be able to access a loan through a borrow money app.

Another aspect of accessibility is the availability of these apps. Many borrow money apps are free to download and can be accessed from anywhere with an internet connection. This means that you can apply for a loan on the go, whether you're at home, at work, or even on vacation.

In addition, some apps offer multiple borrowing options, such as payday loans, personal loans, or installment loans. This means that you can choose the type of loan that best fits your needs and repayment abilities. It also allows you to borrow smaller amounts, which may not be possible with traditional lenders who often have minimum loan amounts.

Overall, the accessibility of borrowing money apps can make them a more convenient and inclusive solution to borrowing money, especially for those who may not have access to traditional lending options. With flexible eligibility criteria and easy access to multiple borrowing options, these apps can help you get the funds you need quickly and efficiently.

Flexibility

One of the key benefits of using borrowed money apps is their flexibility. Unlike traditional lenders who often offer only one type of loan with fixed repayment terms, these apps provide more options and flexibility in borrowing and repayment.

Many borrow money apps offer various types of loans, such as personal loans, payday loans, or installment loans. These loans have different repayment terms, interest rates, and borrowing limits. This means that you can choose the loan that best fits your needs and repayment abilities.

Additionally, most borrowing money apps offer flexible repayment options. You can often choose the loan repayment term, the amount you want to borrow, and the frequency of payments. This means that you can tailor your loan repayment plan to fit your budget and financial goals.

Some apps even offer options for early repayment, which can help you save on interest charges and pay off your loan faster. This can be a useful feature if you want to reduce your debt burden and improve your credit score.

Another aspect of flexibility is the availability of borrowing money apps. Many apps are available 24/7, which means that you can apply for a loan or make a payment at any time. This can be especially helpful in emergency situations when you need funds quickly and outside of regular business hours.

Overall, the flexibility of borrowing money apps makes them a more convenient and customizable solution to borrowing money. With a range of loan options and flexible repayment terms, these apps can help you get the funds you need and manage your debt in a way that works for you.

Lower Interest Rates

One of the biggest advantages of using borrowed money apps is the potential for lower interest rates compared to traditional lenders. Borrow money apps often offer competitive interest rates because they have lower overhead costs and operate entirely online.

Traditional lenders, such as banks and credit unions, have higher operating costs, including rent, salaries, and utilities. These costs are often passed on to borrowers in the form of higher interest rates. However, borrow money apps operate entirely online, which means they have lower overhead costs and can pass these savings on to borrowers in the form of lower interest rates.

Additionally, many borrowing money apps use alternative methods to assess your creditworthiness, such as analyzing your income and spending habits. This means that they can offer more competitive interest rates to borrowers with less-than-perfect credit scores.

Another advantage of using borrowed money apps for emergencies is that you can often compare interest rates from multiple lenders before choosing a loan. Many apps offer a comparison tool that allows you to see the interest rates and fees associated with each loan option. This can help you find the loan with the lowest interest rate and save money over the life of the loan.

It is important to note that the interest rates and fees associated with borrowing money apps can vary widely depending on the lender and the type of loan. It is essential to read the fine print carefully and understand the terms and conditions of the loan before accepting any offer.

Overall, the potential for lower interest rates is a significant advantage of using borrowing money apps for emergencies. With lower overhead costs and alternative credit assessments, these apps can offer more competitive interest rates than traditional lenders and help you save money over the life of the loan.

Improved Credit Scores

Using borrow money apps for emergencies can actually help you improve your credit score if you use them responsibly. One way that this can happen is by making your loan payments on time and in full each month. By doing so, you are demonstrating to lenders that you are a responsible borrower who can manage debt effectively.

Additionally, some borrow money apps offer credit reporting services, which means that your on-time payments will be reported to the major credit bureaus. This can help improve your credit score over time, as lenders will see that you have a history of making timely payments.

It is important to note that not all borrow money apps report to credit bureaus, so it is essential to check with the lender before taking out a loan if you are interested in improving your credit score.

Another way that borrow money apps can help improve your credit score is by paying off high-interest credit card debt. Credit card debt can be particularly damaging to your credit score because it is a revolving debt, which means that you are constantly using and paying off the same debt. By using a borrow money app to pay off high-interest credit card debt, you can lower your credit utilization ratio, which is a factor that makes up 30% of your credit score.

Finally, by using a borrow money app for emergencies, you may be able to avoid missed payments or defaulting on other loans. This can prevent negative marks on your credit report and help improve your overall creditworthiness.

It is important to remember that using borrowing money apps irresponsibly or defaulting on loans can have the opposite effect on your credit score. It is essential to use these apps responsibly and only borrow what you can afford to repay.

Overall, using borrowed money apps for emergencies can help improve your credit score by making on-time payments, paying off high-interest credit card debt, and avoiding missed payments or defaults. However, it is crucial to use these apps responsibly and only borrow what you can afford to repay to avoid damaging your credit score.

Conclusion

Using borrow money apps for emergencies can be a convenient, accessible, and flexible option for those in need of quick financial assistance. Additionally, by using these apps responsibly, you may be able to benefit from lower interest rates and improved credit scores.

However, it is essential to use caution when taking out loans and to only borrow what you can afford to repay. Defaulting on loans or using borrow money apps irresponsibly can lead to serious financial consequences, including damaging your credit score and incurring additional fees and charges.

Overall, borrowing money through apps can be a useful tool for those in financial need. It is important to do your research, compare options, and only borrow what you need and can afford to repay. By doing so, you can benefit from the convenience and flexibility of these apps while avoiding the potential pitfalls of borrowing money irresponsibly.